Watch, Read, Listen

-

Passive And Residual On-line Earnings, Is There A Difference?

Passive And Residual On-line Income, Is There A Difference? There are so lots of trendy phrases on-line, as well as lingo that is as well technical for the average customer, that sometimes it is tough to decode it all. Even with something so very easy as passive revenue and residual revenue. Let us start by…

-

Do You Want To Make Money Online?

Do You Want To Make Money Online? There are actually several ways to generate income online. Some of them are certainly much more rewarding than others, nonetheless. Additionally, there are lots of scams for supposedly generating income online that do not truly work, and you wind up shedding money. As a general policy, if the…

-

Capitalists May Not Be as Diversified as They Think

When greater than 1 million college grads got in the labor force last fall, they started the very first of what can be 7 task actions throughout a 40-year functioning job, according to the Bureau of Labor Statistics. In fact, according to a current research study by Fidelity Investments, one-third of today’s brand-new work force…

-

How to Form a Business LLC & EIN in the USA for Non-US Residents Without SSN As a Foreigner in 2024

**How to Form a Business LLC & EIN in the USA for Non-US Residents Without SSN As a Foreigner in 2024** Forming a Limited Liability Company (LLC) and obtaining an Employer Identification Number (EIN) in the United States can be an attractive proposition for non-US residents. This setup not only provides a flexible business structure…

-

How I Use a Foreign Owned US LLC to Pay 0% US Tax

Title: How I Use a Foreign-Owned US LLC to Pay 0% US Tax Owning a business that operates internationally can be complex, especially when it comes to navigating tax obligations in multiple countries. As an entrepreneur who has gone through this process, I found a legal and effective way to minimize my tax liability using…

-

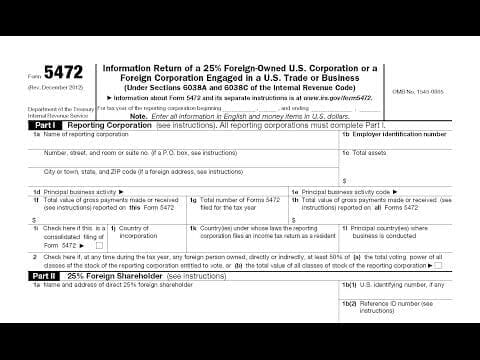

Form 5472, Info. Return of a 25% Foreign-Owned U.S. or Foreign Corp. Engaged in a U.S. Trade or Bus.

Understanding Form 5472: Information Return of a 25% Foreign-Owned U.S. or Foreign Corporation Engaged in U.S. Trade or Business Form 5472 is a critical tax document for certain U.S. businesses that have substantial foreign ownership, as well as for foreign companies engaged in trade or business within the United States. This form plays a pivotal…

-

LLC for Non-US Residents: How to File Taxes

**LLC for Non-US Residents: How to File Taxes** Setting up a Limited Liability Company (LLC) in the United States is an attractive option for non-US residents due to its flexibility in management structure and potential tax benefits. However, understanding the tax obligations and filing requirements that come with owning an LLC can be quite challenging.…

-

Form 5472 for a Foreign Owned Disregarded LLC – Who Needs to File?

**Form 5472 for a Foreign Owned Disregarded LLC – Who Needs to File?** In the realm of US corporate taxation, compliance with reporting requirements for foreign and domestic entities is crucial. One form that is particularly important for foreign entities operating in the United States is Form 5472. This form plays a significant role when…

-

Why a Foreign Owned LLC Pays NO TAXES in the United States

**Why a Foreign-Owned LLC Pays No Taxes in the United States** Understanding the tax obligations of a Limited Liability Company (LLC) owned by non-U.S. residents provides valuable insights into the interplay between international business and American tax law. Remarkably, a foreign-owned LLC can often pay no taxes in the United States, but this depends heavily…