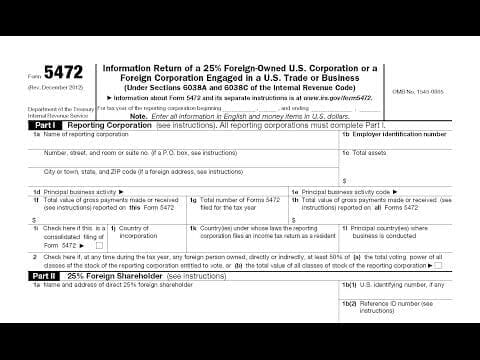

Form 5472 is a critical tax document for certain U.S. businesses that have substantial foreign ownership, as well as for foreign companies engaged in trade or business within the United States. This form plays a pivotal role in ensuring compliance with U.S. tax laws relating to international transactions, serving both to inform the Internal Revenue Service (IRS) about transactions between the filing entity and related parties, and to discourage tax evasion through improper pricing of intercompany transactions.

Who Needs to File Form 5472?

The requirement to file Form 5472 primarily applies to two types of entities:

1. Any U.S. corporation that is at least 25% foreign-owned.

2. A foreign corporation that is engaged in trade or business within the United States (also known as a “25% foreign-owned U.S. DE” when it conducts its activities through a disregarded entity).

A corporation is considered “foreign-owned” if direct or indirect ownership by one foreign person reaches at least 25% at any time during the tax year.

Information Required on Form 5472

Filing Form 5472 involves detailing various types of transactions between the reporting corporation and its related parties (including loans, sales, rents, etc.). The form requires comprehensive information such as:

– The identities of the foreign owners and their percentage of ownership.

– Descriptions and monetary values of transactions between the reporting corporation and its related parties.

– Any changes in ownership structure over the reporting period.

Purpose and Benefits of Filing

The main purpose behind requiring Form 5472 is transparency in international dealings by corporations operating in the U.S., essential for both regulatory purposes and equitable taxation. It helps prevent base erosion and profit shifting (BEPS), where companies move profits from higher-tax jurisdictions to lower-tax jurisdictions, thus reducing their overall tax burden illegally.

Moreover, filing this form helps maintain an accurate record that supports proper transfer pricing practices among multinational companies. Transfer pricing rules require that goods and services traded internally across borders be priced as if they were being sold between unrelated parties under similar circumstances.

Filing Deadlines and Penalties

Form 5472 must be filed alongside the company’s income tax return by its applicable deadline including extensions. Failure to file or incomplete filings can result in substantial penalties typically starting at $25000 per required form per year not filed which emphasizes how critical it is for businesses to ensure compliance.

In Summary

For corporations operating within these guidelines understanding their obligations with respect to Form 5472 is crucial not only for maintaining good standing with tax authorities but also for upholding reputational integrity within global markets Each year brings new challenges particularly with evolving regulations hence staying informed through IRS guidance professional advice or compliance experts can prove invaluable Having accurate timely records goes a long way towards preventing complications during audits thereby smoothing out operations involving cross border commercial activities